Getty Images

Getty ImagesGovernment borrowing fell in the year to November as more money was raised from taxes and less was spent on the country’s debt interest payments, according to official figures.

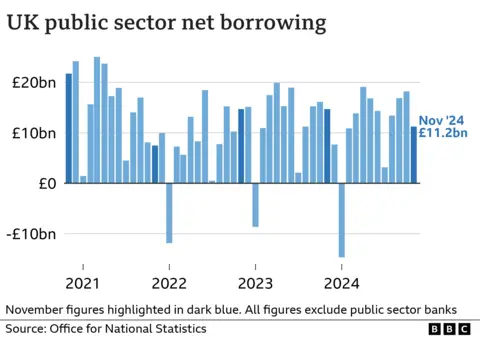

Borrowing – the difference between spending and tax take – was £11.2bn last month, £3.4bn lower than the same month last year and the lowest November figure since 2021.

Debt interest was down £4.7bn from a year earlier to £3bn, mainly due to lower inflation, the Office for National Statistics (ONS) said.

Separate figures from the ONS showed retail sales rose slightly last month, helped by stronger trading at supermarkets.

Retail sales rose 0.2% in November after a 0.7% fall in October, but the rise in sales at supermarkets was partly offset by a fall in clothing sales, the ONS said.

However, its latest survey period did not cover the official Black Friday date of 29 November.

Economists had predicted government borrowing to be around £13bn for November, meaning the actual figure was lower than expected.

It means the total amount the government has borrowed since the start of the current financial year stands at £113.2bn, which is roughly unchanged compared with the same point in 2023/24.

Ruth Gregory, deputy chief UK economist at Capital Economics, said borrowing “undershooting” expectations meant “Christmas has come early” for Chancellor Rachel Reeves.

But she added while the Chancellor would be encouraged by the latest figures, weakening in the UK economy meant there was a growing chance of further tax hikes or spending cuts.

Dennis Tatarkov, senior economist at KPMG UK, added the government had some “temporary respite” due to lower interest repayments, but warned the trend was “unlikely to last as actual and projected inflation has moved up in recent months”.

The latest economic figures come after the Bank of England voted to hold interest rates on Thursday, stating it thought the UK economy had performed worse than expected, with no growth at all between October and December.

The Bank downgraded its growth forecast from 0.3% for the final three months of 2024, to zero growth.

The revisions are a blow to Labour, which has made growing the UK economy its top priority.

Darren Jones, Chief Secretary to the Treasury, said the government had “inherited crumbling public services and crippled public finances” when it entered power.

“Now we have wiped the slate clean, we are focused on investment and reform to deliver growth,” he said.

At the Budget the Chancellor Reeves changed the government’s self-imposed debt rules in order to free up billions for infrastructure spending, which she said would drive economic growth and create jobs.