India has become one of the world’s leading markets for deals such as initial public offerings, smashing its record for money raised this year as investors snap up opportunities.

Vishal Mega Mart Ltd.’s trading debut Wednesday underscored this insatiable appetite for IPOs — shares of the retailer surged more than 40%. The feeding frenzy is set to roll into 2025, according to several women on the front lines.

“We are gearing up for another busy year, both in terms of IPOs and M&A,” said Sonia Dasgupta, a managing director and chief executive officer of investment banking at JM Financial Ltd.

Dasgupta was speaking during a roundtable discussion with other female leaders in Mumbai, talking about India dealmaking and their role in powering the boom.

“Organizations that are able to attract, retain and nurture women have the leverage of a bigger and better pool of talent,” Dasgupta said. Her company’s meritocratic system “always takes precedence,” which results in significant participation by women at various levels, she said.

“In the end, it comes down to someone’s ability and expertise,” added Surbhi Kejriwal, a partner at law firm Khaitan & Co.

On the deals front, multinational companies are considering various options for improving efficiency, and that includes exiting the market, selling shares or expanding, Dasgupta said.

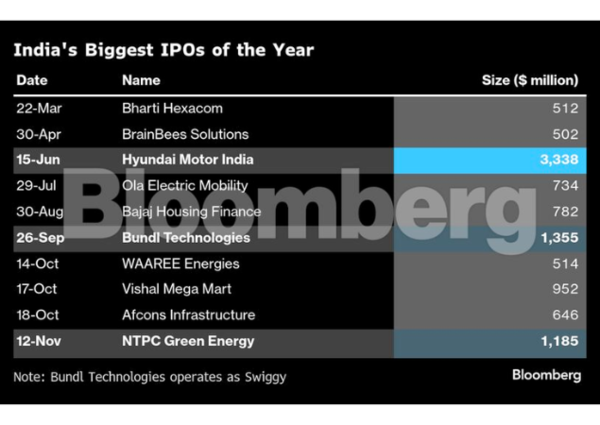

More than $19 billion has been raised in IPOs in India since January, beating the previous annual record of $17.8 billion in 2021. They include the country’s biggest-ever listing, which saw Hyundai Motor Co.’s local unit raise $3.3 billion. Two others — food-delivery firm Swiggy Ltd. and NTPC Green Energy Ltd. — also topped $1 billion, while Vishal Mega Mart’s wasn’t far off.

Strong economic growth has enticed global investors, and the billions of dollars funneled into domestic mutual funds every month have supported the equity markets even when some foreigners were selling. The benchmark Sensex is up roughly 10% in 2024 and surely destined for a ninth-straight year of gains.

“The level of IPO activity in 2024 has been unprecedented, thanks in part to a surge in demand from both institutional and retail investors,” said Dhruvi Kanabar Shahra, the founder of family office DHSK Advisors, who meanwhile noted that technology and remote work have come in handy when forming a family, particularly for women.

“As a mother of very young kids, finding the right work-life balance is key,” she said.

More Deals

More IPOs are on the horizon. LG Electronics Inc. is considering increasing the valuation of its Indian unit to as much as $15 billion in a listing in Mumbai next year, according people familiar with the matter, and Carlyle Group Inc. is said to be weighing an IPO of engineering services firm Quest Global Services Pte.

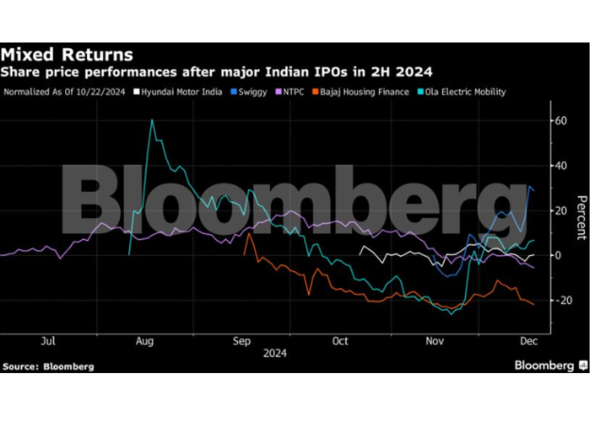

Not all the IPOs have led to stellar gains. After its record effort, Hyundai India is trading below its offer price of 1,960 rupees per share. But winners easily outnumber losers in the bigger IPOs. Bajaj Housing Finance Ltd. is more than 80% above its offer price after listing in September, and both Bharti Hexacom Ltd. and Swiggy have had substantial gains.

A growing chunk of activity may gravitate toward mergers and acquisitions, particularly in areas such as the infrastructure, health-care and consumer sectors, Khaitan’s Kejriwal said.

The volume of M&A deals targeting Indian firms has climbed 19% to $42.3 billion this year, data compiled by Bloomberg show. Quality Care India Ltd., backed by Blackstone Inc., agreed in November to combine with Aster DM Healthcare Ltd. in an all-stock deal to create one of India’s largest hospital chains.

A consortium led by Blackstone also emerged as the preferred bidder for a stake in Haldiram Snacks Pvt., people familiar with the matter have said, following months of negotiations.

Adani Group this week announced plans to consolidate its cement operations by merging two units under Ambuja Cements Ltd. as billionaire Gautam Adani streamlines a business that is vital for India’s infrastructure push.

“We expect a lot more M&A activity in 2025, with financial sponsors driving a big part,” Kejriwal said. “We are seeing increasing interest from global investors, which will likely help India remain a hotspot for dealmaking in Asia.”